Online presentation Aug. 20, 2014

60 days of uncertainty:

Understanding the Affordable Care Act

90 Day Grace Period

This webinar is provided for discussion and informational purposes only.

Participants are encouraged to discuss the requirements and/or their obligations related to the Affordable Care Act with their attorneys or other advisors.

About SCG Health

About SCG Health

The Searfoss Consulting Group, LLC opened in 2011 and is focused on revenue cycle management and strategic planning in this post-health reform world.

Services support the business of medicine with providers, associations, health plans and vendors.

Advocacy Communication & Engagement Education Provider satisfaction driver evaluation Strategic Planning

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Objectives

Objectives

Understand the 90 day grace period policy under the Affordable Care Act

Identify which patients the policy applies to and who it does not

Outline practical solutions to implement in your medical

practice to identify the patients and ways to mitigate retroactive denial

This webinar is provided for discussion and informational purposes only.

Participants are encouraged to discuss the requirements and/or their obligations related to the Affordable Care Act with their attorneys or other advisors.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

|

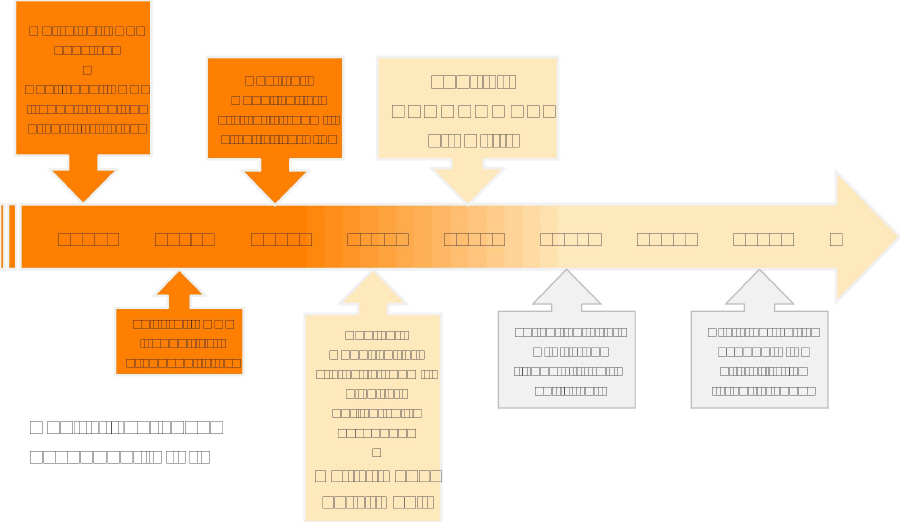

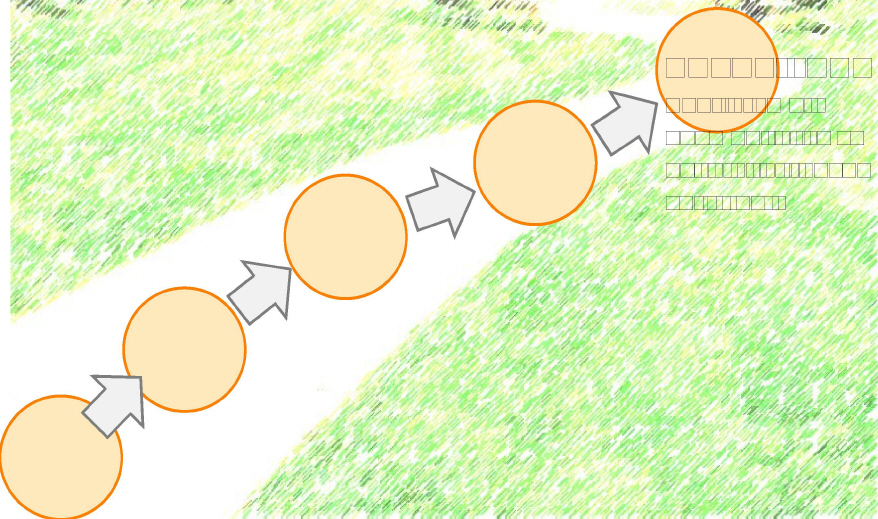

Timeline |

Open enrollment: October each year

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

ACA language

ACA language

P.L. 111-148, Section

1412

ADVANCE DETERMINATION AND PAYMENT OF

PREMIUM TAX CREDITS AND COST-SHARING REDUCTIONS

PAYMENT OF PREMIUM TAX CREDITS AND COST-

SHARING REDUCTIONS

(2)(B)(iv)(II) “allow a 3-month grace period

for

nonpayment of premiums before discontinuing coverage.”

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

|

Categories of beneficiaries |

||

HIX beneficiaries |

|

||

Federal subsidy = Advanced Premium |

insured and small business

policies where |

|

|

(b) qualified health plan product |

|

||

employer bears the risk. Insurance No subsidy = marketplace purchaser

companies only administer the network

and process claims. This falls under federal

jurisdiction. State law does not apply.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

What is the 90 day grace period

Rulemaking finalized 7/15/2013 (on this provision)

45 C.F.R. § 156. 270(d)(3)

“(d) Grace period for recipients of advance payments of the premium tax credit.

“A QHP issuer must provide a grace period of three

consecutive months if an enrollee receiving advance payments of the premium tax credit has previously paid at least one full month's premium during the benefit year. During the grace period, the QHP issuer must:

“(1) Pay all appropriate claims for services rendered to the enrollee during the

first month of the grace period and may pend claims for services rendered to the enrollee in the second and third months of the grace period;

“(2) Notify HHS of such non-payment; and, “(3) Notify providers of the possibility for denied claims when an enrollee

is in the second and third months of the grace period.”

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

The policy in plain language

The policy in plain language

Applies to HIX beneficiaries

Must have received tax credit

Must have paid one month or more in premium

Health plan pays for services rendered during

first month of non-premium payment

Health plan must notify providers of possible

non-payment for services rendered between days 31-90 of premium non-payment

No standard on how notification is provided

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Practical implications

Practical implications

Member and provider

notice mandatory

For APTC beneficiaries, they

are to receive notice upon

delinquency (usually before

day 30) with pending grace

period end date. Once hit

day 31, information is

available to provider.

Patient education

necessary

As newly insured patients,

they may not understand the

importance of paying

premiums.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

End-game

End-game

APTC delinquency premium is not paid within 90 days

Beneficiary liable for any provider charges during

period

Beneficiary liable to health plan for first month's

premium of grace period

Beneficiary liable to federal government for subsidy

Beneficiary is still on the hook for health

insurance and services

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

|

Reality by insured type |

|||

|

State law: |

|||

|

|

|

|

|

|

|

|

||

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

beneficiaries

APTC

Marketplace purchaser

beneficiaries

HIX

Non

Best practices

Best practices

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Patient work flow

Patient work flow

Patient check-out

“Your balance due today is $75.45.

Patient intake

Would you like to pay by cash,

check or credit card?”

Remind patient of premium

payment status, payment

options, deductible and

copayment

Patient scheduling & reminders

Set the expectation of premium payment; service payment at time of service; tell patient their premium payment status, remaining deductible and copayment

Patient education What is their insurance? What is the

premium and what is coinsurance?

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

I (the patient) also understand and

acknowledge that I am personally

responsible to pay (the name of

the practice) in full for services that

my health insurer will not cover

due to non-payment of my health

insurance premiums.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

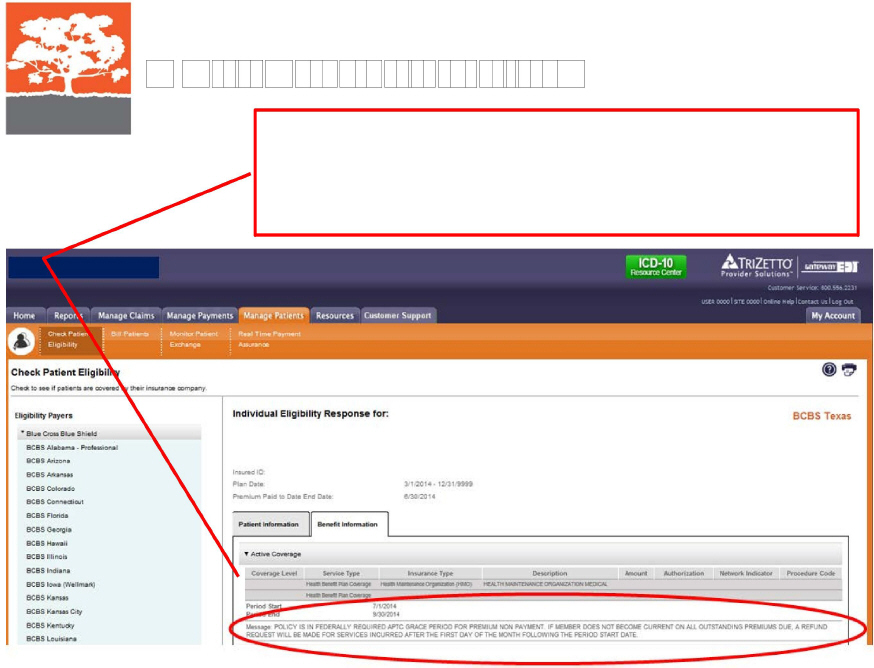

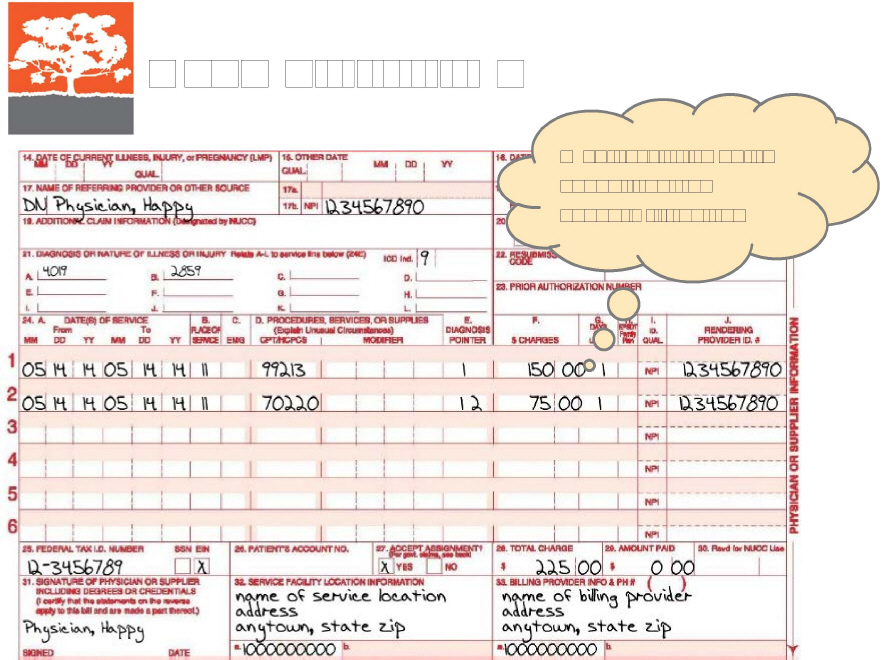

Message: POLICY IS IN FEDERALLY REQUIRED APTC GRACE PERIOD FOR PREMIUM NON PAYMENT. IF MEMBER DOES NOT BECOME CURRENT ON ALL OUTSTANDING PREMIUMS DUE, A REFUND REQUEST WILL BE MADE

FOR SERVICES INCURRED AFTER THE FIRST DAY OF THE MONTH

FOLLOWING THE PERIOD START DATE.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Validate eligibility/prior-auth

Validate eligibility/prior-auth

Electronic Phone Documentation

Document “Is this Copy of patient ID

card at each visit

account in Document Copy photo govt.

delinquency?” issued ID

Document

Date of inquiry

“When was Time of inquiry (can

the last pull call record)

Name of representative premium

Question asked and

paid?” answer provided

Staff training is essential for success!

Front office staff.

Back office staff.

Clinicians too.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Patient engagement

Patient engagement

Charges & self-pay

If patient is delinquent, then

they

are uninsured. What is your

policy? Generally, self-pay

rates will apply.

Best practices:

Claim shows charge rate

Once denial for delinquency

post-90 days, follow your

policy for patients in this

situation.

Be consistent!

For example: show the

charged and “discount” to

self-pay with full payment

expected within 30 days.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Premium payment assistance

Premium payment assistance

Interim final rule for Third Party Payment of Qualified Health Plan Premiums published on 3/14/2014

Both categories of HIX beneficiaries

Certain organizations may pay a portion or all of premium to

qualified health plans (FAQ clarification 2/7/2014) Ryan White HIV/AIDS programs

Indian tribes, tribal organizations and urban Indian organizations Private charitable

Qualified health plans do not have to accept (and are

encouraged to do so) premium payments made by hospitals, other health care providers and commercial entities

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

|

Example: self-pay |

|||||||

|

Service |

Medicare |

Charges |

Band |

Self-Pay |

Band |

|

|

|

99213 |

$73.08 |

$150.00 |

Double |

$110.00 |

Quarter |

|

|

|

70220 |

$39.76 |

$75.00 |

Double |

$60.00 |

Quarter |

|

|

|

If a patient can't

pay their premium due to financial need, how do you know? |

|||||||

|

Establish your policy for all patients that change insurance status |

|

||||||

|

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com. |

|||||||

Discounting policy

Discounting policy

In clear terms, the government reiterated that federal law does not prohibit Medicare, Medicaid and state children's health insurance programs (SCHIP) providers from discounting services to the uninsured.

The government, however, remains Applicable laws

The Medicare Exclusion

suspect of waiver and discount Statute civil only

policies that fail to determine a

The federal Civil Monetary

patient's financial need. Penalty Law civil only

The federal Anti-kickback

Statute criminal only

The federal Stark Law

civil or criminal

The federal False Claims

Act civil or criminal

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

The government provides

review

basis. even for the same patient.

|

no universal definition

of

Special fraud alert

states that

|

|

return or pay stub. |

||

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

|

Checklist of key

policy |

||

In writing!!! |

Consistency across all payer types |

Establishes period

for documentation confidentiality policy |

|

What to ask for from patients: Copy of the latest W2, tax return, pay

stub, bank statement, etc. Were you considered for the Medicaid

program? You may request copy of Medicaid denial letter. Could you

accept a payment plan?

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Your homework

Your homework

Review intake procedures.

Is the front desk able to identify patients? |

|

Are patients aware of their premium

payment status |

|

Are you running and documenting

eligibility for every |

|

|

|

How does your software identify

claims for these |

|

Review your policies.

Know your resources.

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.

Resources

Resources

American Medical Association

http://www.ama-assn.org/ama/pub/ advocacy/topics/affordable-care-act/ aca-grace-period.page

Medical Group Management

Association

State Medical Societies

All rights reserved. 2013-14 Searfoss Consulting Group, LLC. To distribute or copy, please contact jen@SCGhealth.com.