Note: 2016 was the last program year for PQRS. PQRS transitioned to the Merit-based Incentive Payment System (MIPS) under the Quality Payment Program. The final data submission timeframe for reporting 2016 PQRS quality data to avoid the 2018 PQRS downward payment adjustment was January through March 2017. The first MIPS performance period was January through December 2017. For more information, please visit the Quality Payment Program website.

2016 Physician Quality Reporting System (PQRS):

Claims-Based Coding and Reporting Principles

January 2016

The Physician Quality Reporting System (PQRS) is a voluntary quality reporting program that applies a negative payment adjustment to promote the reporting of quality information by individual eligible professionals (EPs) and group practices. The program applies a negative payment adjustment to practices with EPs identified on claims by their individual National Provider Identifier (NPI) and Tax Identification Number (TIN), or group practices participating via the group practice reporting option (GPRO), referred to as PQRS group practices, who do not satisfactorily report data on quality measures for covered Medicare Physician Fee Schedule (MPFS) services furnished to Medicare Part B Fee-for-Service (FFS) beneficiaries (including Railroad Retirement Board and Medicare Secondary Payer). Those who report satisfactorily for the 2016 program year will avoid the 2018 PQRS negative payment adjustment.

For more information on PQRS or the payment adjustment, visit the PQRS webpage.

This document applies only to claims-based coding reporting for PQRS. It does not provide guidance for other Medicare or Medicaid incentive programs, such as the Electronic Health Record (EHR) Incentive Program, or the Value-Based Payment Modifier.

This document describes claims-based coding and reporting, and outlines steps that EPs should take prior to participating in 2016 PQRS.

Please see the Decision Trees for reporting mechanism criteria in the “2016 PQRS Implementation Guide”, found in the PQRS How to Get Started webpage.

|

Step |

Description |

|

Step 1: Fill out claim(s) (QDCs) for reimbursement |

EPs must include a $0.01 line-item charge for the quality-data |

|

Step 2: Reference measure specifications |

To ensure accurate application of PQRS denominator and |

|

Step 3: Double-check claims |

|

|

Step 4: Review Remittance Advice (RA)/ |

Review your Remittance Advice (RA)/Explanation of Benefits |

Below are some helpful tips when reporting via claims.

Claims-Based Reporting Coding

Claims follow a process so the information reaches the CMS National Claims History File (NCH). Current Procedure Terminology (CPT) codes are used to describe medical procedures and physicians' services, and are maintained and distributed by the American Medical Association. Use the CPT codes in the below tables when reporting data.

Use of Current Procedural Terminology (CPT) Category I Modifiers

PQRS measure specifications include specific instructions on including the CPT Category

I modifiers. Unless otherwise specified, CPT Category I codes may be reported with or without CPT modifiers. Refer to each individual measure specification for detailed instructions regarding CPT Category I modifiers that qualify or do not qualify a claim for denominator inclusion.

Note that surgical procedures billed by an assistant surgeon(s) will be excluded from the denominator population so his/her performance rates will not be negatively impacted for PQRS. Analysis will exclude otherwise PQRS-eligible CPT Category I codes, when submitted with assistant surgeon modifiers 80, 81, 82, or AS. The primary surgeon, not the assistant surgeon, is responsible for performing and reporting the quality action(s) in applicable PQRS measures.

o The Technical Component (TC) modifier is removed from 2016 PQRS. The TC modifier represents when the procedure is for a technical component only.

Eligible CPT Category I procedure codes, billed by surgeons performing surgery on the same patient, submitted with modifier 62 (indicating two surgeons, i.e., dual procedures) will be included in the denominator population for applicable PQRS measure(s). Both surgeons taking part in PQRS will be fully accountable for the clinical action(s) described in the PQRS measure(s).

Use of CPT II Modifiers

CPT II modifiers are unique to CPT II codes and may be used to report measures by

appending the appropriate modifier to a CPT II code as specified for a given measure. The modifiers for a code cannot be combined and their use is guided by the measure's coding instructions, which are included in the numerator coding section of the measure specifications. Use of the modifiers is unique to CPT II codes and may not be used with other types of CPT codes. Only CPT II modifiers may be appended to CPT II codes. Descriptions of each modifier are provided below to help identify circumstances when the use of a modifier may be appropriate. Note that reporting an exclusion or reporting modifier will alter an EP's performance rate. Accurate reporting on all selected measures will count toward the reporting requirements, whether the clinical action is reported as complete or not complete (or performance met or not met).

CPT II code modifiers fall into two categories; exclusion modifiers and the 8P reporting modifier.

Exclusion modifiers may be appended to a CPT II code to indicate that an action

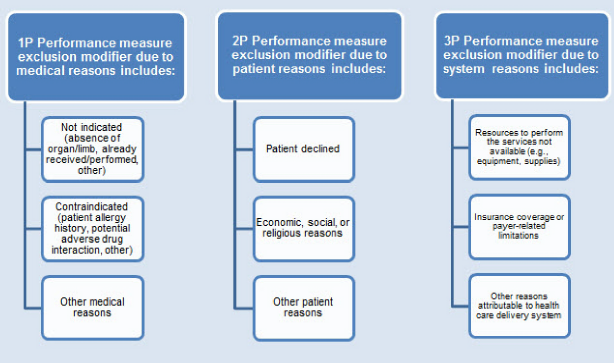

specified in the measure was not provided due to medical, patient, or system reason(s) documented in the medical record. These modifiers serve as denominator exclusions for the purpose of measuring performance. Not all exclusions will apply to every measure, and some measures do not allow any performance exclusions. Appending a performance measure exclusion modifier falls into one of three categories; see the graphic below for more detail.

Performance Measure Exclusion Modifier Categories

There may be instances in which a G-code is indicated to represent performance

exclusion. The G-code may encompass the concepts of a medical, patient, and/or system exclusion.

Generally, the 8P reporting modifier is available for use only with CPT II codes to facilitate reporting an eligible case when an action described in a measure is not performed and the reason is not specified. Instructions for appending this reporting modifier to CPT Category II codes are included in applicable measures. Use of the 8P reporting modifier indicates that the patient is eligible for the measure; however, there is no indication in the record that the action described in the measure was performed, nor was there any documented reason attributable to the exclusion modifiers. 8P Performance measure reporting modifier - action not performed, reason not otherwise specified.

The 8P reporting modifier facilitates reporting an eligible case on a given measure when the clinical action does not apply to a specific encounter. EPs can use the 8P modifier to receive credit for satisfactory reporting but will not receive credit for performance. EPs should use the 8P reporting modifier sensibly for applicable measures they have selected to report. The 8P modifier may not be used freely in an attempt to meet satisfactory reporting criteria without regard toward meeting the practice's quality improvement goals.

Note: A 0% performance rate occurs when all of the eligible denominator encounters are reported as “Performance Not Met” from the numerator options for a measure. The recommended clinical quality action must be performed on at least 1 patient for each individual measure reported by the individual eligible professional (EP) or group practice. A 0% performance rate could be due to the fact that none of the eligible patients (or encounters) was in compliance for the measure or the correct quality action was not provided to the patient. The one exception to this rule applies to inverse measures, where higher quality moves the performance rate towards 0%. In this instance, the performance rate must be less than 100% and a 0% would be considered satisfactorily reported.

Claims-Based Reporting Principles

The “2016 Physician Quality Reporting System (PQRS) Measure Specifications” contain

ICD-10-CM coding. For more information, see the PQRS ICD-10 webpage.

The CMS-1500 claim form (02/12) is available for use to accommodate ICD-10-CM

coding.

The CMS-1450 form (UB-04 at present) can be used by an institutional provider to bill a Medicare fiscal intermediary when a provider qualifies for a waiver from the Administrative Simplification Compliance Act requirement for electronic submission of claims. It is also used for billing of institutional charges to most Medicaid State Agencies. Please contact your Medicaid State Agency for more details on their requirements for this paper form.

A sample CMS-1500 form can also be found in the “2016 PQRS Implementation Guide” on the PQRS Measures Codes webpage.

EPs in Critical Access Hospital Method II (CAH II) will need to continue to add their NPI to the CMS-1450 claim form for analysis of PQRS reporting at the NPI-level.

Diagnoses should be reported in form locator field (FL) 66-67 a-q on the CMS-1450 claim form. Up to 12 diagnoses can be reported in item 21 on the CMS-1500 paper claim (02/12) (see the 2016 PQRS Implementation Guide) and up to 12 diagnoses can be reported in the header on the electronic claim.

o Only one diagnosis can be linked to each line item.

o PQRS analyzes claims data using ALL diagnoses from the base claim (item 21 of the CMS-1500 or electronic equivalent) and service codes for each individual EP (identified by individual NPI).

o EPs should review ALL diagnosis and encounter codes listed on the claim to make sure they are capturing ALL measures chosen to report that are applicable to the patient's care.

All diagnoses reported on the base claim will be included in PQRS analysis, as some measures require reporting more than one diagnosis on a claim.

o For line items containing QDCs, only one diagnosis from the base claim should be referenced in the diagnosis pointer field.

o To report a QDC for a measure that requires reporting of multiple diagnoses, enter the reference number in the diagnosis pointer field that corresponds to one of the measure's diagnoses listed on the base claim. Regardless of the reference number in the diagnosis pointer field, all diagnoses on the claim(s) are considered in PQRS analysis. (See 2016 PQRS Implementation Guide).

If your billing software limits the number of line items available on a claim, you must add a $0.01 nominal amount to one of the line items on that second claim for a total charge of one penny.

o PQRS analysis will subsequently join the claims based on the same beneficiary for the same date-of-service, for the same TIN/NPI and analyzed as one claim.

o Providers should work with their billing software vendor/clearinghouse regarding line limitations for claims to ensure that diagnoses, QDCs, or nominal charge amounts are not dropped.

o In an effort to streamline reporting of QDCs across multiple CMS quality reporting programs, CMS strongly encourages all EPs and practices to bill 2016 QDCs with a $0.01 charge. EPs should pursue updating their billing software to accept the $0.01 charge prior to implementing 2016 PQRS. EPs and practices need to work with their billing software or EHR vendor to ensure that this capability is activated.

QDCs are specified Current Procedure Terminology (CPT) II codes (with or without modifiers)

and G-codes used for submission of PQRS data. QDCs can be submitted to Medicare

Administrative Contractors (MACs) either through:

• Electronic-based submission (using the ASC X 12N Health Care Claim Transaction [version 5010]);

OR

• Paper-based submission using the CMS-1500 claim form (use version 02-12) or CMS-1450 claim form.

o PQRS analysis will subsequently join claims based on the same beneficiary for the same date-of-service, for the same Taxpayer Identification Number/National Provider Identifier (TIN/NPI) and analyze as one claim.

o Providers should work with their billing software vendor/clearinghouse regarding line limitations for claims to ensure that diagnoses, QDCs, or nominal charge amounts are not dropped.

Principles for Reporting QDCs

The following principles apply for claims-based reporting of PQRS measures:

QDCs must be reported:

On the claim(s) with the denominator billing code(s) that represents the eligible Medicare Part B PFS encounter.

For the same beneficiary.

For the same date of service (DOS).

By the same EP (individual NPI) who performed the covered service, applying the appropriate encounter codes (ICD-10-CM, CPT Category I, or HCPCS codes). These codes are used to identify the measure's denominator.

QDCs must be submitted with a line-item charge of $0.01 at the time the associated covered service is performed:

The line item charge should be $0.01 the beneficiary is not liable for this nominal amount.

Entire claims with a $0.01 charge will be rejected.

The $0.01 charge is submitted to the MAC and then the PQRS code line will be denied but will be tracked in the National Claims History (NCH) for analysis.

When a group bills, the group NPI is submitted at the claim level; therefore, the individual rendering/performing physician's NPI must be placed on each line item (field 24J on CMS-1500 form or electronic equivalent; form locators 56, 76, 77, 78 and 79 on CMS 1450 form), including all allowed charges and quality-data line items. Solo practitioners should follow their normal billing practice of placing their individual NPI in the billing provider field (#33a on the CMS-1500 form or the electronic equivalent or form locators 56, 76, 77, 78 and 79 on CMS 1450 form).

Note: Claims may NOT be resubmitted for the sole purpose of adding or correcting QDCs.

The RA/EOB denial code N620 is your indication that the PQRS codes are valid for the 2016 PQRS reporting year.

The N620 denial code is just an indicator that the QDC codes are valid for 2016 PQRS. It

does not guarantee the QDC was correct or that reporting thresholds were met. However, when a QDC is reported satisfactorily (by the individual EP), the N620 can indicate that the claim will be used in calculating satisfactory reporting.

o EPs who bill on a $0.00 QDC line item will receive the N620 code. EPs who bill on a $0.01 QDC line item will receive the CO 246 N620 code.

o All submitted QDCs on fully processed claims are forwarded to the CMS warehouse for analysis by the CMS quality reporting program, so providers will first want to be sure they do see the QDC's line item on the RA/EOB, regardless of whether the RA (N620) code appears.

Keep track of all cases reported so that you can verify QDCs reported against the

remittance advice notice sent by the MAC. Each QDC line-item will be listed with the N620 denial remark code.

The RARC code N620 is your indication that the PQRS codes were received into the CMS National Claims History (NCH) database.

EPs who bill with $0.00 charge on a QDC line item will receive an N620 code on the

EOB.

N620 reads: This procedure code is for quality reporting/informational purposes only.

EPs who bill with a $0.00 charge on a QDC line item will receive an N620 code on the

EOB and may or may not receive any Group Code or CARC.

The CARC 246 with Group Code CO or PR and with RARC N620 indicates that this procedure is not payable unless non-payable reporting codes and appropriate modifiers are submitted.

In addition to N620, the remittance advice will show Claim Adjustment Reason Code

(CARC) CO or PR 246. (This non-payable code is for required reporting only.)

CARC 246 reads: This non-payable code is for required reporting only.

EPs who bill with a charge of $0.01 on a QDC item will receive CO 246 N620 on the

EOB.

Claims processed by the MAC must reach the national Medicare claims system data warehouse (NCH file) by February 24, 2017 to be included in analysis. Claims for services furnished toward the end of the reporting period should be filed promptly.

For more information on reporting individual measures via claims, please see the following resources available on the PQRS Measures Codes webpage.

o 2016 Physician Quality Reporting System (PQRS) Measure Specifications and/or Release Notes

o 2016 Physician Quality Reporting System (PQRS) Individual Measures Specifications and Measures Flow Guide for Claims and Registry Reporting

o 2016 Physician Quality Reporting System (PQRS) Measures List

o 2016 Physician Quality Reporting System (PQRS) Implementation Guide

For more information on the other 2016 PQRS GPRO reporting mechanisms, see the “2016 PQRS Measures List” on the PQRS How to Get Started webpage or the new PQRS Web-Based Measure Search Tool.

For more information related to the 2016 PQRS payment adjustment, please refer to the PQRS webpage on the CMS website.

For more information on what's new for 2016 PQRS, visit the PQRS Educational

To find answers to frequently asked questions, visit the CMS FAQ webpage.

Contact the QualityNet Help Desk at 1-866-288-8912 (TTY 1-877-715-6222), available 7 a.m. to 7 p.m. Central Time Monday through Friday, or via e-mail at qnetsupport@hcqis.org. To avoid security violations, do not include personal identifying information, such as Social Security Number or TIN, in email inquiries to the QualityNet Help Desk.

2016 PQRS Claims-Based Coding and Reporting Principles (V1.0, 1/19/2016)

CPT only copyright 2015 American Medical Association. All rights reserved.