OnSTAFF 2000

Management Menu/Analysis

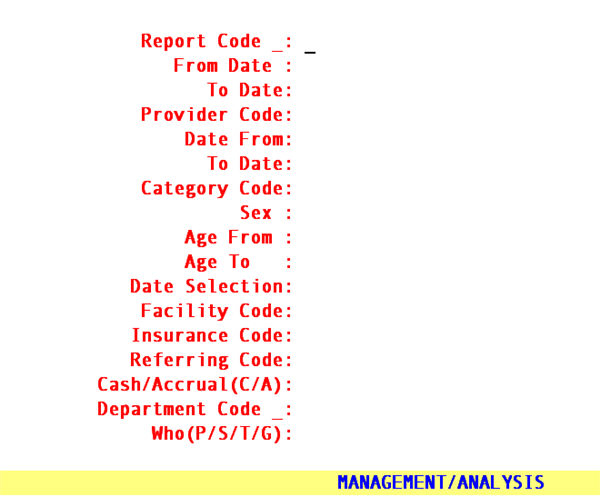

There are twenty-six (26) analysis reports available. These reports may be accessed by entering 1 through 8, A through M, P, Q, U, V, X or Y in the /Management/Analysis <Report Code> field. The following is information regarding analysis reports:

Report Code Description

Analysis and Utilization Reports

A Practice Analysis by Clinic

B Practice Analysis by Provider

C Analysis by Insurance by Clinic

D Remittance Report

E Payment Analysis by Clinic

F Payment Analysis by Provider

G Adjustment Analysis by Clinic

H Adjustment Analysis by Provider

I Analysis by Category by Clinic

J Analysis Summary by Clinic

L Analysis Summary by Provider

M Analysis by Patient Category/Facility

and Procedure Category/Facility

Utilization Reports Summary

P Utilization Report by Clinic/Pay Plan

Q Utilization Report by Provider/Pay Plan

U Utilization Report by Clinic

V Utilization Report by Provider

X Utilization Report by Clinic

/Procedure Category

Y Utilization Report by Provider

/Procedure Category

1 Utilization Report by Clinic/Insurance

2 Utilization Report by Provider/Insurance

3 Utilization Report by Clinic/Referring

4 Utilization Report by Provider/Referring

5 Utilization Report by Clinic/Facility

6 Utilization Report by Provider/Facility

7 Utilization Report by Clinic/Procedure

8 Utilization Report by Provider/Procedure

Summary of /Management/Analysis Date Fields

(<From Date> and <To Date>, <Date From> and <To Date>)

Report Codes A, B, C, I, J, and L

The first set of dates (<From Date> and <To Date> fields):

Are always the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field.

The second set of dates (<Date From> and <To Date> fields):

Are always entry date of payments and adjustments or when left blank, ALL payments and adjustments posted to date, but ONLY those payments and adjustments which were posted against the procedures (charges) specified in the first set of dates.

Report Code D

The first set of dates (<From Date> and <To Date> fields):

Are always entry date of the charges.

The second set of dates (<Date From> and <To Date> fields):

Since the first set of dates are always entry date of the procedure(s) (charge(s)) the second set of dates are always service date of charges.

Report Codes E, F, G, and H

The first set of dates (<From Date> and <To Date> fields):

Are always entry date of payments or adjustments.

The second set of dates (<Date From> and <To Date> fields):

Since the first set of dates are always entry date of payments or adjustments, the second set of dates are not used.

Report Code M

The first set of dates (<From Date> and <To Date> fields):

Are always entry or service dates of the charges as specified in the <Entry/Service Date(E/S)> field, for year to date (YTD).

The second set of dates (<Date From> and <To Date> fields):

Since the first set of dates are the entry or service dates of the procedures (charges) for year to date (YTD), the second set of dates request the entry or service dates of the procedures (charges) for period to date (PTD).

Report Code P, Q, U, V, X, Y, and 1 through 8

The first set of dates (<From Date> and <To Date> fields):

Are always the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field.

The second set of date fields (<Date From> and <To Date>):

Are always entry date of payments and adjustments or when left blank, ALL payments and adjustments posted to date, but ONLY those which were posted against the procedures (charges) specified in the first set of dates.

Analysis and Utilization Reports

View Sample Utilization Reports (Created in Intellect)

Analysis and Utilization Reports display requested information as it was at the time of posting the charge. The heading of each report will contain the /Utility/Set Up/Clinic <Name>, <Address, Zip Code, City, State>, and <Phone> field entries. Reports printed for the clinic will not print the provider name in the report heading. Reports printed for a specific provider will print the /Utility/Provider <Provider Code> and <Name>. The first set of <From> and <To> dates refer to the first set of date ranges specified in the <From Date> and <To Date> fields when requesting the report. These dates generally refer charges. The second set of <From> and <To> dates refer to the second set of date ranges specified in the <Date From> and <To Date> fields when requesting the report. These dates generally refer to payments and adjustments. Only one set of dates appearing on a report signifies the <Date From> and <To Date> fields (second set of date fields) were bypassed (left blank), thus requesting all payments and adjustments. The page number, when the report is prepared, the calendar date, military time, and the /Utility/Set Up/Security/Login Users <Operator Name> field entry will also be noted on the report. See the following examples:

Reports for the clinic:

TITLE OF THE REPORT HERE

Prime Clinical Systems, Inc.

80 S. Lake Ave. #708

Pasadena, CA 91101

(626) 449-1705

From: 01/01/97 To: 01/31/97

From: 01/01/97 To: 03/31/97

Page: 1 Report prepared on: Tues Sept 09 17:02:38 1997 By: Judi

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

Reports for a specific provider:

TITLE OF THE REPORT HERE

Prime Clinical Systems, Inc.

80 S. Lake Ave. #708

Pasadena, CA 91101

(626) 449-1705

Dr.: (1) James Anderson, M.D.

From: 01/01/97 To: 01/31/97

Page: 1 Report prepared on: Tues Sept 09 17:02:38 1997 By: Judi

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

MANAGEMENT/ANALYSIS REPORT CODE A

Report Code: A Practice Analysis by Clinic

This is a twofold report for the clinic:

First: A report prints for all the charges, payments, adjustments, and occurrences of the charges grouped by procedure code (/Utility/Procedure <Panel Code>).

Second: A summary report prints for all the charges, payments, and adjustments grouped by procedure category (/Utility/Procedure <Category>). The summary report may be printed as a separate report by requesting Report Code J.

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: This field will be bypassed.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category

Code: Enter the /Utility/Category <Category Code> if you want this report for one category only, otherwise bypass this field by pressing [Enter].

Sex: â

Age From: â

Age To: Press [Enter] on these three fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE A PRINTED REPORT

First part of the report:

Report Title: PRACTICE ANALYSIS REPORT

Key: The /Utility/Procedure <Panel Code>

CPT: The /Utility/Procedure <Code C>

E/M: The /Utility/Procedure <Code E>

Treatment: The /Utility/Procedure <Description >

Report Code: A Practice Analysis by Clinic

Price: The /Utility/Procedure <Charge Global>

Occurrence: The number of times this procedure was posted during the date range (entry or service date) specified in the first set of dates (<From Date> and <To Date> fields).

Charge: The total amount posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields) for this procedure.

Payment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date>), but ONLY payments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date>). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date>), but ONLY adjustments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date>). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Second part of the report:

Report Title: PRACTICE ANALYSIS SUMMARY REPORT

Group: The /Utility/Procedure <Category>.

If procedure categories are not set up in /Utility/Set Up/Field Choices for <Field Name> pr_lnr, the following will print in the Description column of the report:

"Procedure Category not Setup"

Report Code: A Practice Analysis by Clinic

Description: The /Utility/Set Up/Field Choices (<Field Name> pr_lnr) <Description> column entry for the noted Group.

Charge: The total amount for all procedures posted with this category (see <Group> above) during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields).

Occurrence: The number of times a procedure with this category was posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields).

Payment: The total amount posted during the entry dates specified in the second set of dates (<From Date> <To Date> fields), but ONLY payments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<From Date> <To Date> fields), but ONLY adjustments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

NOTE: The report TOTAL of payments and adjustments will not match the Financial Report total payments and adjustments (Today’s Payments and Today’s Adjustments) since this report is noting ONLY amounts posted (entered) against charges identified in the first set of dates whereas the Financial Report is noting ALL amounts posted on a particular entry date, no matter what the date of service was.

MANAGEMENT/ANALYSIS REPORT CODE B

Report Code: B Practice Analysis by Provider

This is a twofold report for a specific provider:

First: A report prints for all the charges, payments, adjustments, and occurrences of the charges grouped by procedure code (/Utility/Procedure <Panel Code>).

Second: A summary report prints for all the charges, payments, and adjustments grouped by procedure category (/Utility/Procedure <Category>). The summary report may be printed as a separate report by requesting Report Code L.

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: Enter the desired /Utility/Provider <Provider Code> of the provider for whom the report is for.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category

Code: Enter the /Utility/Category <Category Code> if you want this report for one category only, otherwise bypass this field by pressing [Enter].

Sex: â

Age From: â

Age To: These fields will be bypassed.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE B PRINTED REPORT

Refer to REPORT CODE A.

MANAGEMENT/ANALYSIS REPORT CODE C

Report Code: C Analysis by Insurance/Clinic

This report prints for the clinic the charges, payments, and adjustments grouped by current primary insurance of all patients as defined in the /New Patient Insurance screen.

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: This field will be bypassed.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category Code: â

Sex: â

Age From: â

Age To: Press [Enter] on these four fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE C PRINTED REPORT

Report Title: INSURANCE PRODUCTION REPORT

Name: The /Utility/Insurance <Name>.

Address: The /Utility/Insurance <Address>.

City: The /Utility/Insurance <City>.

State: The /Utility/Insurance <State>.

Zip: The /Utility/Insurance <Zip Code>.

Charge: The total amount posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields) for this insurance.

Payment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date> fields), but ONLY payments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date> fields), but ONLY adjustments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, adjustments posted during the first quarter of the year against charges for the month of January.

See NOTE.

NOTE: The report TOTAL of payments and adjustments will not match the Financial Report total payments and adjustments (Today’s Payments and Today’s Adjustments) since this report is noting ONLY amounts posted (entered) against charges identified in the first set of dates whereas the Financial Report is noting ALL amounts posted on a particular entry date, no matter what the date of service was.

MANAGEMENT/ANALYSIS REPORT CODE D

Report Code: D Remittance Analysis by Clinic

This report prints for the clinic or a specific provider the patient charges, unit value, conversion factor, net payment (approved amount), actual payment, and adjustment grouped by /Utility/Category. Subtotals will print for each category.

From Date:

To Date: These dates identify the entry date of the charges.

Provider

Code: Enter the desired /Utility/Provider <Provider Code> of the provider for whom the report is for, otherwise press [Enter] to obtain a report for the clinic.

Date From:

To Date: These dates identify the service date of the charges.

Category

Code: Enter the /Utility/Category <Category Code> if you want this report for one category only, otherwise bypass this field.

Sex: â

Age From: â

Age To: â

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE D PRINTED REPORT

Report Title: REMITTANCE REPORT

ACN: The patient account number.

Name: The /New Patient <Name(Last, First Int.)>

CAT.: The patient category (/Utility/Category <Category Code>).

Date: The service date of the charge.

CPT/RVS: The billed /Utility/Procedure <Code R (E or C)>.

Description: The /Utility/Procedure <Description> of the billed charge.

Charge

Submitted: The posted charge amount.

Unit Value: The unit value utilized by the patient pay plan.

Conv.

Factor: The conversion rate utilized by the patient pay plan.

Net.

Payment: The calculated approved amount from a contractual agreement based on unit values and conversion rates or a fee schedule approved amount (/Utility/Procedure/Fee Schedule <Approved>).

Actual

Payment: The total (cumulative) payments posted.

Adjustment: The total (cumulative) adjustments posted.

NOTE: ‘0.00’ or ‘ ‘ (blank) will print under the following report headings when, at the time of posting the charge(s), the necessary set up has not been entered for contracts based on either unit values and conversion rates or a fee schedule:

Unit Values

Conv. Factor

Net. Payment

MANAGEMENT/ANALYSIS REPORT CODE E

Report Code: E Payment Analysis by Clinic

This report prints for the clinic the total payment amount and number of payments by the /Utility/Messages/Remark <Remark Code> used to identify the payment source.

From Date:

To Date: These dates identify the entry date of the payments and should NEVER be for the current entry date.

Provider Code: This field will be bypassed.

Date From: â

To Date: â (not used)

Category Code: â

Sex: â

Age From: â

Age To: â

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE E PRINTED REPORT

Report Title: PAYMENT ANALYSIS REPORT

Code: The source of payment remark code (/Utility/Messages/Remark <Remark Code>) used at the time of posting the payment.

Description: The /Utility/Messages/Remark <Description> of the source of payment remark code (see <Code> above).

Type: The /Utility/Messages/Remark <Remark Type> of the remark code (see <Code> above).

Amount: The total amount of payments posted using this source of payment remark code (see <Code> above) during the date range specified in the first set of dates (<From Date> and <To Date> fields).

%: The percentage of the total amount (sum of the Amount column) this individual amount is.

Count: The number of times this source of payment remark code was used during the date range specified in the first set of dates (<From Date> and <To Date> fields).

%: The percentage of the total count (sum of the Count column) this individual count is.

MANAGEMENT/ANALYSIS REPORT CODE F

Report Code: F Payment Analysis by Provider

This report prints for a specific provider the total payment amount and number of payments by the /Utility/Messages/Remark <Remark Code> used to identify the payment source.

From Date:

To Date: These dates identify the entry date of the payments and should NEVER be for the current entry date.

Provider

Code: Enter the desired /Utility/Provider <Provider Code> of the provider for whom the report is for.

Date From: â

To Date: â (not used)

Category Code: â

Sex: â

Age From: â

Age To: â

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE F PRINTED REPORT

Refer to REPORT CODE E.

MANAGEMENT/ANALYSIS REPORT CODE G

Report Code: G Adjustment Analysis by Clinic

This report prints for the clinic the total adjustment amount and number of adjustments by the /Utility/Messages/Remark <Remark Code> used to identify the adjustment source.

From Date:

To Date: These dates identify the entry date of the adjustments and should NEVER be for the current entry date.

Provider

Code: This field will be bypassed.

Date From: â

To Date: â (not used)

Category Code: â

Sex: â

Age From: â

Age To: â

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE G PRINTED REPORT

Report Title: ADJUSTMENT ANALYSIS REPORT

Code: The source of adjustment remark code (/Utility/Messages/Remark <Remark Code>) used at the time of posting the adjustment.

Description: The /Utility/Messages/Remark <Description> of the source of adjustment remark code (see <Code> above).

Type: The /Utility/Message/Remark <Remark Type> of the remark code (see <Code> above).

Amount: The total amount of adjustments posted using this source of adjustment remark code (see <Code> above) during the date range specified in the first set of dates (<From Date> and <To Date> fields).

%: The percentage of the total amount (sum of the Amount column) this individual amount is.

Count: The number of times this source of adjustment remark code was used during the date range specified in the first set of dates (<From Date> and <To Date> fields).

%: The percentage of the total count (sum of the Count column) this individual count is.

MANAGEMENT/ANALYSIS REPORT CODE H

Report Code: H Adjustments Analysis by Provider

This report prints for a specific provider the total adjustment amount and number of adjustments by the /Utility/Messages/Remark <Remark Code> used to identify the adjustment source.

From Date:

To Date: These dates identify the entry date of the adjustments and should NEVER be for the current entry date.

.

Provider

Code: Enter the desired /Utility/Provider <Provider Code> of the provider for whom the report is for.

Date From: â

To Date: â (not used)

Category Code: â

Sex: â

Age From: â

Age To: â

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE H PRINTED REPORT

Refer to REPORT CODE G.

MANAGEMENT/ANALYSIS REPORT CODE I

Report Code: I Analysis by Category/Clinic

This report prints for the clinic the total charges, payments, and adjustments grouped by current category of all patients as defined in the /New Patient <Category> field.

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: This field will be bypassed.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category Code: â

Sex: â

Age From: â

Age To: Press [Enter] on these four fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

ABOUT CODE I PRINTED REPORT

Report Title: CATEGORY PRODUCTION REPORT

Code: The patient category (/Utility/Category <Category Code>).

Description: The /Utility/Category <Description> of the category code (see <Code> Above).

Charge: The total amount posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields) for this category.

Payment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date> fields), but ONLY payments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date> fields), but ONLY adjustments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, adjustments posted during the first quarter of the year against charges for the month of January.

See NOTE.

NOTE: The report TOTAL of payments and adjustments will not match the Financial Report total payments and adjustments (Today’s Payments and Today’s Adjustments) since this report is noting ONLY amounts posted (entered) against charges identified in the first set of dates whereas the Financial Report is noting ALL amounts posted on a particular entry date, no matter what the date of service was.

MANAGEMENT/ANALYSIS REPORT CODE J

Report Code: J Practice Analysis by Clinic

This report prints for the clinic a summary for all the charges, payments, and adjustments grouped by procedure category (/Utility/Procedure <Category>).

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: This field will be bypassed.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category

Code: Enter the /Utility/Category <Category Code> if you want this report for one category only, otherwise bypass this field by pressing [Enter].

Sex: â

Age From: â

Age To: Press [Enter] on these three fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

PRINTED REPORT CODE J

Report Title: PRACTICE ANALYSIS SUMMARY REPORT

Group: The /Utility/Procedure <Category>.

If procedure categories are not set up in /Utility/Set Up/Field Choices for <Field Name> pr_lnr, the following will print in the Description column of the report:

"Procedure Category not Setup"

Description: The /Utility/Set Up/Field Choices (<Field Name> pr_lnr) <Description> column entry for the <Group> above.

Charge: The total amount posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields) for charges with this category (see <Group> above).

Occurrence: The number of times a procedure with this category was posted during the date range (entry date or service date) specified in the first set of dates (<From Date> and <To Date> fields).

Payment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date>), but ONLY payments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, payments posted during the first quarter of the year against charges for the month of January.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<Date From> and <To Date>), but ONLY adjustments which were posted against the procedures (charges) specified in the first set of dates, entry date or service date (<From Date> and <To Date> fields). For example, adjustments posted during the first quarter of the year against charges for the month of January.

See NOTE.

NOTE: The report TOTAL of payments and adjustments will not match the Financial Report total payments and adjustments (Today’s Payments and Today’s Adjustments) since this report is noting ONLY amounts posted (entered) against charges identified in the first set of dates whereas the Financial Report is noting ALL amounts posted on a particular entry date, no matter what the date of service was.

MANAGEMENT/ANALYSIS REPORT CODE L

Report Code: L Practice Analysis by Provider

This report prints for a specific provider a summary for all the charges, payments, and adjustments grouped by procedure category (/Utility/Procedure<Category>).

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

Provider

Code: Enter the desired /Utility/Provider <Provider Code> of the provider for whom the report is for.

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but ONLY those which were posted against the charges identified in the first set of dates.

Category

Code: Enter the /Utility/Category <Category Code> if you want this report for one category only, otherwise bypass this field by pressing [Enter].

Sex: â

Age From: â

Age To: Press [Enter] on these three fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

PRINTED REPORT CODE L

Refer to REPORT CODE J.

MANAGEMENT/ANALYSIS REPORT CODE M

Report Code: M Analysis Report by Patient Category/Facility and Procedure Category/Facility

This is a twofold report for the clinic which prints the period to date (PTD) and year to date (YTD) totals:

First: A report prints for all charges, payments, and adjustments grouped by patient category (/Utility/Category <Category Code>) and place of service (/Utility/Facility <Facility Code>). Totals are printed for each category.

Second: A report prints for all charges, payments, and adjustments grouped by procedure category (/Utility/Procedure <Category>) and place of service (/Utility/Facility <Facility Code>). Totals are printed for each procedure category.

From Date:

To Date: These dates identify:

a) The entry or service dates of the procedures (charges) for the year to date(YTD) as specified in the <Entry/Service Date(E/S)> field below.

b) The entry date of the payments and adjustments for the year to date (YTD).

Provider

Code: This field will be bypassed.

Date From:

To Date: These dates identify:

a) The entry date or service dates of the charges for the period to date (PTD) as specified in the <Entry/Service Date(E/S)> field below.

b) The entry date of the payments and adjustments for the period to date(PTD).

Category Code: â

Sex: â

Age From: â

Age To: Press [Enter] on these four fields since they do not apply to this report.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

PRINTED REPORT CODE M

Report Title: FINANCIAL ANALYSIS REPORT

First section of the report:

Financial

Class: The category code and category description (/Utility/Category <Category Code> and <Description>).

POS: The place of service code (/Utility/Facility <Facility Code>) of the facility services were rendered at.

Name: The name (/Utility/Facility<Name>) of the facility services were rendered at.

PTD: The total charges posted during the date range (entry date or service date) specified in the second set of dates, the period to date (<Date From> and <To Date> fields) for this financial class and place of service.

Count: The number of charges the PTD total consists of for this financial class and place of service.

YTD: The total charges posted during the date range specified in the first set of dates, the year to date (<From Date> and <To Date> fields) for this financial class and place of service.

Count: The number of charges the YTD total consists of for this financial class and place of service.

PTD

Payment: The total amount posted during the date range (in this case entry date) specified in the second set of dates (<Date From> and <To Date> fields) for this financial class and place of service.

PTD

Adjustment: The total amount posted during the date range (in this case entry date) specified in the second set of dates, the period to date (<Date From> and <To Date> fields) for this financial class and place of service.

YTD

Payment: The total amount posted during the date range (in this case entry date) specified in the first set of dates (<From Date> and <To Date> fields) for this financial class and place of service.

YTD

Adjustment: The total amount posted during the date range (in this case entry date) specified in the first set of dates, the year to date (<From Date> and <To Date> fields) for this financial class and place of service.

Second section of the report:

Revenue

Department: The procedure category and procedure category description (/Utility/Procedure <Category> and /Utility/Set Up/Field Choices <Description> column entry for <Field Name> pr_lnr).

If procedure categories are not set up in /Utility/Set Up/Field Choices for <Field Name> pr_lnr, the following will print in the Description column of the report:

"Procedure Category not Setup"

POS: The place of service code (/Utility/Facility <Facility Code>) of the facility services were rendered at.

Name: The name (/Utility/Facility<Name>) of the facility services were rendered at.

PTD: The total charges posted during the date range (entry date or service date) specified in the second set of dates, the period to date (<Date From> and <To Date> fields) for this revenue department and place of service.

Count: The number of charges the PTD total consists of for this revenue department and place of service.

YTD: The total charges posted during the date range specified in the first set of dates, the year to date (<From Date> and <To Date> fields) for this revenue department and place of service.

Count: The number of charges the YTD total consists of for this revenue department and place of service.

PTD

Payment: The total amount posted during the date range (in this case entry date) specified the second set of dates, the period to date (<Date From> and <To Date> fields) for this revenue department and place of service.

PTD

Adjustment: The total amount posted during the date range (in this case entry date) specified in the second set of dates, the period to date (<Date From> and <To Date> fields) for this revenue department and place of service.

YTD

Payment: The total amount posted during the date range (in this case entry date) specified in the first set of dates, the year to date (<From Date> and <To Date> fields) for this revenue department and place of service.

YTD

Adjustment: The total amount posted during the date range (in this case entry date) specified in the first set of dates, the year to date (<From Date> and <To Date> fields) for this revenue department and place of service.

MANAGEMENT/ANALYSIS UTILIZATION REPORTS

Report Code: P, Q, U, V, X, Y, 1, 2, 3, 4, 5, 6, 7, and 8

Utilization Reports Summary

Report Code P, Q, U, X, 1, 3, 5, and 7 for the clinic and Report Code V, Y, 2, 4, 6, and 8 for a specific provider prints all the charges, payments, adjustments, and occurrences of the charges for a particular group specified in the reports Code field as follows:

Report Code Specifics:

P, Q Grouped by the pay plan of the patient as it was set at the time charges were posted.

U, V Grouped by the category of the patient as it was set at the time charges were posted.

X, Y Group by the /Utility/Procedure <Category>. Each Choice and it’s Description MUST BE entered at /Utility/Messages/Remark also.

1, 2 Prints all primary insurance charges grouped by the primary insurance of the patient as it was set at the time charges were posted.

3, 4 Grouped by the referring doctor as it was set at the time charges were posted (/Utility/Set Up/Parameter <Referring>).

5, 6 Grouped by the facility (Utility/Facility <Facility Code>) that the charges were posted against.

7, 8 Grouped by /Utility/Procedure <Panel Code>.

Report Codes: P, Q, U, V, X, Y, 1, 2, 3, 4, 5, 6, 7, and 8

Utilization Reports

From Date:

To Date: These dates identify the entry date or service date of the charges as specified in the <Entry/Service Date(E/S)> field below.

|

Provider Code: |

For Reports for the clinic: This field will be bypassed.

|

For Reports for a specific provider: Enter the desired /Utility/Provider <Provider Code> of the provider whom this report is for. |

Date From:

To Date: These dates identify the entry date of the payments and adjustments, but NOT ONLY those which were posted against the charges identified in the first set of dates, but ALL payments and adjustments which were posted within the noted second set of dates.

Category

Code: Press [Enter] on this field since it does not apply to this report.

Sex: Press [Enter] to include both males and females. To limit the report by sex, enter:

M - limit the report to males

F - limit the report to females

Age From: Press [Enter] to include all ages. To limit the report by age, enter the beginning age in whole years only.

Age To: Press [Enter] to include all ages. To limit the report by age, enter the ending age in whole years only.

Date Selection:

E The first set of dates identify the entry date of the charges.

S The first set of dates identify the service date of charges.

Facility Code: For all code types the default is all facilities (leave blank). To request the report for a specific facility, type the Utility --►Facility <Facility Code>.

Insurance Code: For all code types the default is all primary insurers (leave blank).To request the report for a specific primary insurer, type the Utility --►Insurance <Insurance Co Code>.

Referring Code: For all code types the default is all referrals (leave blank). To request the report for a specific referral source, type the Utility --►Referring <Referring Code>.

Cash/Accrual (C/A) It's important to understand the basics of the two principal methods of keeping track of a business's income and expenses: cash method and accrual method (sometimes called cash basis and accrual basis). In a nutshell, these methods differ only in the timing of when transactions, including procedures and payments, as they are credited or debited to your accounts. The accrual method is the more commonly used method of accounting Under the accrual method, transactions are counted when the procedure occurs (DOS), the services occur, regardless of when the money for them is actually received or paid. In other words, income is counted when the procedure occurs (DOS). Under the cash method, income is not counted until cash (or a check) is actually received. The default is “C” cash

Department Code: For all code types the default is all departments (leave blank).To request the report for a specific department, type the Utility --►Provider <Department > name or number.

Who (P/S/T/G): Press enter, accepting the default, asterisk (*), for this report to include ALL /Ledger/Accounting or /Open Item line items regardless of what the <W> (Who column) is set to. OR enter the who column value (P, S, T, G, Q, or Y) by which to limit this report

PRINTED REPORTS P, Q, U, V, X, Y, 1, 2, 3, 4, 5, 6, 7, and 8

Report Title for Report Code:

P, Q PAY PLAN UTILIZATION REPORT

U, V CATEGORY UTILIZATION REPORT

X, Y PROCEDURE CATEGORY UTILIZATION REPORT

1, 2 INSURANCE UTILIZATION REPORT

3, 4 REFERRING UTILIZATION REPORT

5, 6 FACILITY UTILIZATION REPORT

7, 8 PROCEDURE UTILIZATION REPORT

Code: Depending on the report being printed this column entry defaults from one of the following areas:

Report Code Area of On-Staff (see NOTE)

P, Q /Utility/Insurance/Pay Plan/Pay Plan <Plan Code>

U, V /Utility/Category <Category Code>

X, Y /Utility/Procedure <Category>

1, 2 /Utility/Insurance <Insurance Co. Code>

3, 4 /Utility/Referring <Referring Code>

5, 6 /Utility/Facility <Facility Code>

7, 8 /Utility/Procedure <Panel Code>

Description

/Name: Depending on the report being printed this column entry defaults from one of the following areas:

Report Code Area of On-Staff (see NOTE)

P, Q /Utility/Insurance/Pay Plan/Pay Plan <Name>

U, V /Utility/Category <Description>

X, Y /Utility/Messages/Remark <Description>

1, 2 /Utility/Insurance <Name>

3, 4 /Utility/Referring <Name>

5, 6 /Utility/Facility <Name>

7, 8 /Utility/Procedure <Description>

NOTE: At the time of posting charges if a particular group (see Code above) is not set up OR if after posting charges that particular group has been deleted, the utilization report will contain the following:

CODE DESCRIPTION

P, Q PLAN Plan not Setup

U, V CAT Category not Setup

X, Y PR Category not Setup

1, 2 Ins. Cash or no Insurance

3, 4 Ref. Referring not Setup

5, 6 POS POS not Setup

Occurrence: The number of line item charges posted during the date range (entry or service date) specified in the first set of dates (<From Date> and <To Date> fields) for this group (see Code above).

Patient

Count: The number of patients included in this group (see Code above).

%: The percentage of the total patient count (sum of the Patient Count column) this individual patient count is.

Visits: The number of visits (dates of service) for the patients in the Patient Count for this group (see Code above).

Charges: The total charges posted for this group (see Code above), during the date range specified in the first set of dates (<From Date> and <To Date> fields).

Payments: The total amount posted during the entry dates specified in the second set of dates (<From Date> and <To Date> fields), but NOT ONLY those which were posted against the procedures (charges) specified in the first set of dates, but ALL payments which were posted within the noted second set of dates.

See NOTE.

Adjustment: The total amount posted during the entry dates specified in the second set of dates (<From Date> and <To Date> fields), but NOT ONLY those which were posted against the procedures (charges) specified in the first set of dates, but ALL adjustments which were posted within the noted second set of dates.

See NOTE.

Group 1: â

Group 2: â

Group 3: â

Group 4: The aged balance for this group (see Code above) based on the /Utility/Category <Aging Method> and <Aging Group 1, 2, 3 and 4> field entries.

NOTE: The report TOTAL of payments and adjustments will match the Financial Report total payments and adjustments (Today’s Payments and Today’s Adjustments) when the reports second set of dates (<Date From> and <To Date> fields) match the date of the Financial Report since this report will note ALL amounts posted on that particular entry date.

View Sample Analysis Reports (Created in Intellect)