Intellect™

PAYMENT MENU OPTIONS

Auto Payment

Automatic Payment Journal for ERA

After clicking the [Commit/Exit] button on the Payment --► Auto Payment screen, Intellect produces an Automatic Payment Journal with detailed Electronic Remittance Advice (ERA) information for each charge line including approved, deductible, payment, adjustment, co-insurance, and reason codes. When the program is unable to match records in the ERA file to charges posted in Intellect, a second report is produced (see III - Error Report below).

• When an ERA 835 file is downloaded via automation OR Payment --► Auto Payment <Post Payment/Report> is set to ‘Report’ (to manually download ERA or print report), the payments and adjustments are NOT posted. See ERA Pickup & Print Report for details.

• When Payment --► Auto Payment <Post Payment/Report> is set to ‘Pay & Report’, the payments and adjustments are applied to patient accounts according to the Automatic Payment Journal. See Post ERA for details.

NOTE: The following conditions are used to match charges posted in Intellect to the Automatic Payment Journal: 1) Patient Account Number, 2) Date of Service, 3) CPT Code, 4) Modifier, and 5) Charge Amount. If the same submitter number is used for multiple Intellect clinics, the payments for all clinics may be included on the same ERA 835 file. The ERA file must be posted via the Auto Payment screen within the same clinic(s) as the charges.

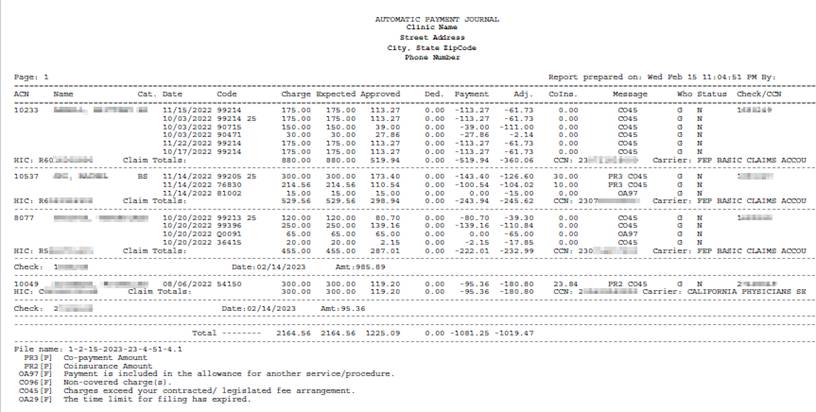

Sample Automatic Payment Journal

In this Topic Hide

1. ACN

1.1 Displays the account number from the ERA 835 file Loop 2100 Segment CLP01.

1.2 To post the ERA, a match must be found with <Patient Account No> field on the Registration --► Regular --► Patient OR Registration --► Worker --► Worker.

2. Name

2.1 Displays the patient’s LAST NAME, FIRST NAME and MIDDLE INITIAL from the ERA 835 file Loop 2100 Segments NM103 NM104 NM105.

2.2 Effective version 9.12.10, the patient’s name is only listed once.

3. Cat. (Category)

3.1 Displays the patient’s <Category> from the Registration --► Regular --► Patient OR Registration --► Worker --► Worker screen.

4. Date

4.1 Displays the date of service (DOS) from the ERA 835 file Loop 2110 DTM02.

4.2 To post the ERA, a match must be found with the DOS entered at the time of posting (or Charges --► Modify [Information] <To Date> field prior to submitting electronic claim).

5. Code

5.1 Displays the procedure code and modifiers from the ERA 835 file Loop 2110 Segments SVC01-2, SVC01-3, SVC01-4, SVC01-5, SVC01-6.

5.2 To post the ERA, a match must be found with CPT code (or Revenue Code) and modifiers entered at the time of posting.

6. Charge

6.1 Displays the charge amount from the ERA 835 file Loop 2110 Segment SVC02.

6.2 To post the ERA, a match must be found with charge amount entered at the time of posting (or modified prior to submitting the electronic claim).

7. Expected

7.1 Effective version 19.12.04 - added: Displays the expected <Approved> amount pulled from Utility --► Procedure --►Fee Schedule at the time of charge posting. If the fee schedule is not set up, Intellect pulls the charge amount as the ‘Expected’.

7.2 This field is informational only.

8. Approved

8.1 Displays the insurance approved amount from the ERA 835 file Loop 2110 AMT02.

8.2 Effective version 17.02.17, when posting primary insurance payments, Intellect updates the th_actual approved if the amount is greater than zero and displays this ‘Approved’ amount on various Management reports.

8.3 Effective version 18.08.31, when posting primary insurance payments, Intellect will set the ‘Approved’ amount to $0.00 for denied claims.

9. Ded. (Deductible)

9.1 Displays the amount from the ERA 835 file Loop 2100 Segment CAS03 when the associated Reason Code (see 13 below) is identified as Deductible (Utility --► Messages --► Reason Codes <Status> = ‘D’). For example: ‘PR1’ for Deductible Amount.

9.2 NOTE: Intellect adjusts off the Deductible amount ONLY IF Payment --► Auto Payment <Adjust Cross Over> is set to ‘Yes’ when posting payments for Medi-Medi crossover patients (where Utility --► Insurance --► Insurance <Type> = 1).

10. Payment

10.1 Displays the payment amount from the ERA 835 file Loop 2110 Segment SVC03.

10.2 NOTE: Intellect ALWAYS posts the payment amount regardless of Reason Codes associated with the charge.

11. Adj. (Adjustment)

11.1 Displays the amount from ERA 835 file Loop 2100 Segment CAS03 when the associated Reason Code (see 13 below) is set to apply the adjustment (Utility --► Messages --► Reason Codes <Status> = ‘Y’, ‘F’ when posting primary insurance payments, or ‘O’ when posting secondary insurance payments).

11.2 NOTE 1: Intellect adjusts off the Deductible amount (Utility --► Messages --► Reason Codes <Status> = ‘D’) ONLY IF Payment --► Auto Payment <Adjust Cross Over> is set to ‘Yes’ when posting payments for Medi-Medi crossover patients.

11.3 NOTE 2: Intellect adjusts off the Co-Insurance amount (Utility --► Messages --► Reason Codes <Status> = ‘P’) ONLY IF Payment --► Auto Payment <Adjust Cross Over> is set to ‘Yes’ or ‘Exclude Deductible’ when posting payments for Medi-Medi crossover patients.

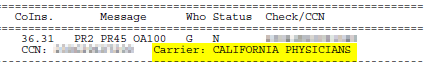

12. CoIns. (CoInsurance)

12.1 Displays the amount from the ERA 835 file Loop 2100 Segment CAS03 when the associated Reason Code (see 13 below) is identified as Co-Insurance (Utility --► Messages --► Reason Codes <Status> = ‘P’). For Example: ‘PR2’ for Coinsurance Amount.

12.2 NOTE: Intellect adjusts off the Co-Insurance amount ONLY IF Payment --► Auto Payment <Adjust Cross Over> is set to ‘Yes’ or ‘Exclude Deductible’ when posting payments for Medi-Medi crossover patients.

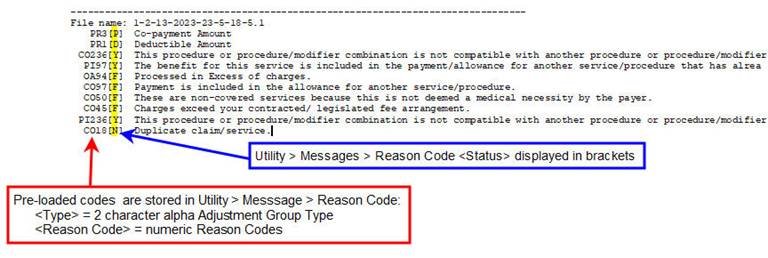

13.1 Displays the adjustment Reason Codes from the ERA 835 file Loop 2100 Segments CAS01 CAS02.

13.2 The Utility --► Messages --► Reason Codes <Status> field determines whether or not adjustments are applied and the <Who> field changes to the next responsible party.

13.3 NOTE: All Reason Codes that appear on the report are listed at the end with the Utility --► Messages --► Reason Codes <Status> and <Description> (see 20.2 below).

14. NPI - REMOVED

14.1 Prior to version 19.12.04: Displays the billing provider’s NPI.

15. Who

15.1 Displays the responsible party (e.g., ‘P1,’ ‘P2,’ ‘S1,’ ‘T1,’ ‘G’) after the payments and adjustments are applied.

15.2 The Utility --► Messages --► Reason Codes <Status> field determines IF the <Who> field changes to the next responsible party.

16. Status

16.1 Displays ‘Y’ if the primary insurance making the payment forwarded the claim to the secondary insurance. (Also see 18.4 below).

16.2 Displays ‘N’ if the insurance making the payment did NOT forward the claim to another insurance.

17. Check/CCN

17.1 Displays the Check or EFT Trace number from the ERA 835 file Segment TRN02.

17.2 The ‘Error Report’ displays ‘Charge not fnd’ (see sample below).

18. The last line for each account displays:

18.1 HIC (Health Insurance Claim): Displays the Subscriber ID from the ERA 835 file Loop 2100 Segment NM109.

18.2 Claim Totals: Calculates subtotals for the Charge, Expected, Approved, Ded., Payment, and Adj. columns.

18.3 CCN (Claim Control Number): Displays the Payer Claim Control Number from the ERA 835 file Loop 2100 Segment CLP07.

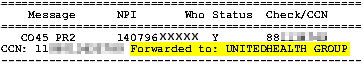

18.4 Forwarded to (effective version 9.12.16): When posting the primary insurance payment and Status column = ‘Y,’ the name of the secondary insurance who received the crossover claims is listed.

18.5 Carrier (effective version 21.02.26): displays the Insurance making the payment when the Status column is ‘N.’

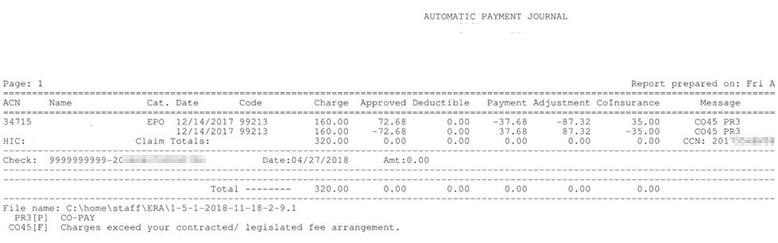

19. The following are displayed for each check:

![]()

19.1 Check: Displays the Check or EFT Trace number from the ERA 835 file Segment TRN02

19.2 Date: Displays the check issue date or EFT effective date from the ERA 835 file Segment BPR16.

19.3 Amt (Amount): Displays the paid amount from the ERA 835 file Segment BPR02

20. The following is displayed at the end of the report:

![]()

20.1 Total: Calculates totals for the Charge, Expected, Approved, Ded., Payment, and Adj. columns.

20.2 File name: Assigned by Intellect when the ERA 835 file is downloaded.

20.3 All Reason Codes that appear in the <Message> column (see 13 above) are listed with the associated Utility --► Messages --► Reason Codes <Status> in brackets and <Description>.

20.4 IMPORTANT REMINDER: Intellect allows users to modify the Utility --► Messages --► Reason Codes <Status> field prior to posting ERA 835 files.

20.4.1 When set to ‘D’ (for ‘Deductible’ reason codes only), the amount is displayed in the Ded. column. If no other adjustments reason codes are associated with the charge line, the <Who> field changes to the next responsible party. For example:

• If posting the ‘P1’ Primary Insurance payment, the <Who> field changes to ‘S1’ Secondary Insurance responsibility OR ‘G’ for guarantor/patient responsibility when there is no secondary insurance.

• If posting the Secondary Insurance payment, the <Who> field changes to ‘G.’

20.4.2 When set to ‘F,’ the adjustment is only applied if FROM the Primary Insurance. The <Who> field changes to the next responsible party even if the adjustment amount is not applied.

20.4.3 When set to ‘G,’ the adjustment is NOT applied but the <Who> field changes to the next responsible party.

20.4.4 When set to ‘N,’ the adjustment is NOT applied and the <Who> field is NOT changed.

20.4.5 When set to ‘O,’ the adjustment is only applied if NOT FROM the Primary Insurance. The <Who> field changes to the next responsible party even if the adjustment is not applied.

20.4.6 When set to ‘P’ (for ‘Co-insurance’ reason codes only), the amount is displayed in the CoIns. column. This status option has no effect on the adjustment applied or the <Who> field.

20.4.7 When set to ‘Y,’ the adjustment is applied regardless the source AND the <Who> field is changed to the next responsible party.

1. Effective version 18.08.31:When a payer takes back payments and/or adjustments from a previous ERA file, Intellect makes the reversal of the payments and adjustments based on the new ERA file. For example:

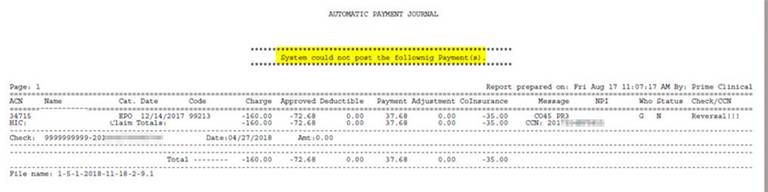

2. Prior to version 18.08.31: When a payer took back previously posted payment and/or adjustments from charges, the program printed the Reversal information the Error Report, so it required manually adjusting off the previously posted amounts. For example:

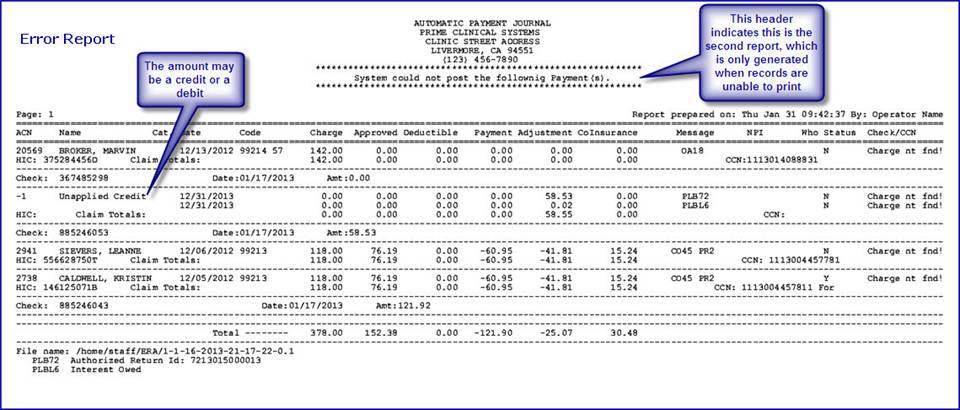

If there are any records on the ERA 835 file that Intellect is unable to match to charges posted in Intellect, a separate 'Error Report’ is generated with the header ‘System could not post the following Payment(s)’ (see below). Intellect cannot apply the payments and adjustments on the ‘Error Report’ so they must be posted manually.

1. Claim or Service Not Found:

1.1 The claim/service on the ERA file must find a match with ALL of the following: ACN, Date, Code, Modifier and Charge.

1.2 Prior to version 9.12.14: When the same submitter number was used for multiple Intellect clinics,the charges associated with another clinic were included on the ‘Error Report’.

2. Provider Level Balance (PLB) Reason Codes:

2.1 The ‘Unapplied Credit’ from the ERA 835 file Segment PLB is an adjustment to the total amount paid that is NOT specific to a particular claim or service.

2.1.1 Examples of PLB adjustments that DECREASE the total amount paid are loan repayment, penalty withholding, and overpayment recovery.

2.1.2 Examples of PLB adjustments that INCREASE the total amount paid are interest payment, bonus payment, and capitation payment.

2.2 Effective version 13.03.01: Unapplied credits or debits from the payer are displayed on both the Automatic Payment Journal report and Error Report (see samples above). The report displays ‘Unapplied Credit’ for both credit and debit amounts.